OVERVIEW OF THE HRIS PLANNING GUIDE

Founded in 2003, HRMS is a human capital technology advisory, implementation and consulting services firm enabling mid-market companies throughout the U.S. and Canada to manage, empower, engage and optimize their workforce with leading HR, Payroll and Talent Management solutions.

As a selective group of experienced professionals and certified HR technology specialists, our mission is to serve as a trusted advisor to prospects and clients seeking new solutions to their human capital challenges. Our promise of integrity, objectivity and credibility ensures the absolute best experience when evaluating, acquiring and implementing people management solutions

Human Capital is arguably the most important resource within an organization today. This has become even more apparent in a competitive global economy. Even today, with a national unemployment rate at 6.2%, finding and acquiring highly skilled and dedicated employees has its challenges. We believe it is critical for companies to invest in HR technology to establish the infrastructure and business processes to acquire, train, assess, develop and lead their employees in the most effective and efficient way possible to gain market share.

The intent of this Planning Guide is to help your organization begin the process of narrowing the search for HRIS vendors to ensure their software solutions meet your project requirements – features, functionality, delivery model, customer support, vendor viability, vendor vision, and price. We defined a HRIS (Human Resource Information System) to include the following capabilities: recruiting and on-boarding, core HR, benefits and attendance administration, compensation and performance management, training and development, salary and succession planning, employee, manager and candidate self-service capabilities. To help simplify the search for a HRIS, we have classified the providers of HRIS systems into six distinct categories. This classification will help you begin the process of narrowing your search for a qualified vendor.

HRMS attempts to be as accurate as possible when describing any vendor and/or software capabilities or related product information represented in this report. The Report content is based on information gathered in good faith from both primary and secondary sources, whose accuracy cannot always be guaranteed. HRMS Solutions, however, makes no representations or warranties, expressed or implied, that the software capabilities, product information or any other content in this report is current, complete or error-free. All trademarks are the property of their respective owners. The HRIS Planning Guide contains copy-written material and may not be reproduced, published or distributed without the express written permission from HRMS Solutions, Inc.

In no event shall HRMS Solutions, its officers, directors, employees or agents be liable to any part for any indirect, incidental, special or consequential damages, including without limitation, any loss of profits or sales, or lost goodwill, whether arising from contract, tort or negligence, arising out of or related to (1) any use of this report or the information contained herein, or (2) the accuracy, completeness, or timeliness, of this report.

CLASSIFICATION OF VENDORS BY DELIVERY MODEL

Depending on where your HRIS database resides, vendors may offer their solution using more than one delivery model. These vendors typically fall into the following classifications:

HRIS (ON-PREMISE) VENDORS

2Interact, Auxillium West, Epicor HCM, gNeil, Humanic Design, Infor (fka Lawson), Insperity, Kronos, Mangrove Software, Ignite Technologies (aka NuView Systems), OmnipriseHRM, Oracle (eBusiness), OrangeHRM, PDS Software, People-Trak, Perfect Software, Sage North America, SAP America, Sigma-HR USA, Simple HR, Trak-It Solutions, and Vantage Point Software

HRIS (CLOUD-BASED) VENDORS

ADP (Workforce Now / Vantage), Ascentis Corporation, Auxillium West, BambooHR, Ceridian (Dayforce), CheckPoint HR, Electronic Commerce, Inc (ECI), Effortless HR, Epicor HCM, Harvest HCM, HR Cloud, Fairsail HCM, FinancialForce HCM, Gecko HRM, HR Cloud, HRNet Software Systems, InfinityHR, Meta4, Navotron HCM, NetSuite Tribe HR, NuView Systems, PeoplesHR, PeopleStrategy, PowWowHR, SuccessFactors, SentricWorkforce, Silkroad Heartbeat, SumTotal, Triton, Vantage Point Software, and Workday.

HRIS & PAYROLL (ON-PREMISE) VENDORS

2Interact, Accero (formerly Cyborg Systems), ECI, High Line, Infor (fka Lawson) Kronos, Mangrove Software, Meta4, Microsoft Dynamics, Mid-Range Software, Millennium, Now Solutions, NuView Systems (fka Cort Software), Optimum Solutions, Oracle (eBusiness / Fusion) PDS Software, Perfect Software, Sage North America, SAP America, Sapien, Unicorn HRO (fka SoftwarePlus and Open4), Vibe HCM.

HRIS & PAYROLL (CLOUD-BASED) VENDORS

ADP (Payforce, PayXpert, Workforce Now), Ceridian (Dayforce), CheckPoint HR, CloudPay, Exponent Technologies, Humanic Design, Infinisource, Insperity, Intuit, NetSuite ERP, Paychex, Paycom, Paycor, Paylocity, Payroll Control Systems, Payroll Network, Salary.com (fka Genesys), Sentric Workforce, Sigma-HR USA, SinglePoint, SurePayroll, Ultimate Software, and Workday

ERP VENDORS

Deltek, Extensity (fka GEAC), Epicor, Fourth Shift, Infor (fka Lawson, SSA Global or Infinium), NetSuite, Oracle Fusion (fka PeopleSoft and JD Edwards), Mapics, Meditech, Microsoft Dynamics (fka Great Plains, Navision, Solomon), QAD, Ramco Systems, Ross Systems, Sage North America, and SAP America

HR BPO (BUSINESS PROCESS OUTSOURCING) VENDORS

Accenture, ADP, Ceridian, Convergys, Hewitt Associates, IBM Global Services, NorthGateArinso, Platform One and TriNet

CLASSIFICATION OF VENDORS BY VERTICAL OFFERING

THE MARKET PLACE

Cloud technology is no longer a dream and vendors have been spending billions to build, acquire and assemble their platform for the peak of adoption. The heavy merger and acquisition activity of the last three years has been a result of this shift in strategy by both large and small providers; but not every company will purchase this delivery model, as there are still valid reasons for selecting an on-premise system.

The cloud-based HCM war started when PeopleSoft was acquired by Oracle’s hostile takeover in 2005. Dave Duffield and Aneel Bhusri started a company called Workday based on a model being delivered by a CRM software company called Salesforce.com. As Workday accelerated its growth and big multi-national companies announced they had moved to Workday, other’s noticed and this produced 24-36 months of heavy M&A activity, unseen in the Human Capital Management software business. SAP’s acquisition of SuccessFactors in December 2011, followed shortly afterward by Salesforce’s acquisition of social performance platform Rypple, continued the pace and Oracle’s own acquisition of Taleo and so on. Who will be the dominant leader is still to be determined, but there are some clear leaders at this point.

Today, over half of the HR Software solutions are only available as a cloud-based offering. Below, we try to help you target the appropriate vendor and delivery model for your business within this ever-changing landscape.

TIER 1 VENDORS

The Tier 1 vendors, which traditionally serve the largest of enterprises, have been leaders in HCM (Human Capital Management) for at least 20 years. There are primarily four vendors that lead the ERP vendor category in HRIS/HRMS sales, which includes:

- Infor (formerly Lawson)

- Oracle (Fusion / Taleo)

- SAP America (SuccessFactors)

- Workday

Originally, these vendors designed their solutions to accommodate the requirements for complex, global companies that typically had annual revenue of more than $1 billion. These vendors have strong domestic and international brand awareness and offer a suite of applications, including ERP (Enterprise Resource Planning), HCM (Human Capital Management), CRM (Customer Relationship Management), SCM (Supply Chain Management), SFA (Sales Force Automation) and PSA (Professional Service Automation).

Tier 1 Vendor solutions are highly functional and typically built on high performance technology platforms, which require significant levels of client-side internal resources to maintain and support. These systems take months (or even years) to deploy and require a significant financial investment ($500k – $20 million). Workday, the new kid on the block, is poised to change the HCM industry forever by offering a true multi-tenant global Cloud based solution, with a paradigm shift on what should be expected from a modern HCM solution. This shift in technology allows companies never to be left behind when it comes to upgrades, eliminating customizations and the costs associated.

TIER 2 VENDORS

Tier 2 vendors provide solutions to organizations that typically have gross revenue of $50 million to $1 billion and range in employee size from 1,000 to 10,000. Since many Fortune 5,000 companies have already invested millions of dollars in Human Capital Management solutions over the years, the Tier 1 ERP vendors have been re-positioning their offerings to serve smaller Tier 2 and Tier 3 mid-market customers (called downstreaming). You can see the strategy clearly from vendors such as Oracle with its recent acquisition of Taleo which is designed for companies with as little as 10 employees. The larger ERP vendors have been trying to change the perception that their solutions are only built for the enterprise-level workforce. They also seek additional revenue streams by extending their acquisitions to new markets. As a further case in point, Epicor Software Corporation, a mid-market global ERP provider, recently purchased Spectrum HR Systems Corporation, and now offers iVantage HRIS as the newly relabeled Epicor HCM, now available to existing ERP clients and as a best in class standalone HRIS.

Many vendors in this group offer solutions that are just as functional and technically advanced as the Tier 1 providers, but typically at a lower cost – both from a software license / SaaS and implementation standpoint. A few vendors in this category include FinancialForce HCM, SuccessFactors, PDS Software (Vista), Kronos, ADP and Ceridian.

There has also been a new surge with smaller ERP vendors that are well positioned to offer a suite of applications to Tier 2 and 3 level organizations with a scaled down version of the Tier 1 ERP products. Vendors such as FinancialForce, Microsoft, Sage Software, and Deltek are just a few examples. The solutions from these vendors include everything from time collection, financials, payroll, self-service and HR. Their solutions can be licensed and installed on-premise or delivered as a “Subscription” or Cloud model. A common definition of a “Subscription” model is a traditional on-premise solution that is now offering their solution with managed hosting services. These “Subscription” or “On-Demand” offerings are typically deployed as a single tenanted deployment that eliminates hardware and infrastructure cost, but not upgrade or new release overhead.

In our experience, these Tier 2 solutions cost significantly less than ERP vendor offerings, have a lower Total Cost of Ownership (TCO) and can be implemented and deployed within a 6 to 9 month period.

TIER 3 VENDORS

Tier 3 vendors offer solutions are designed to accommodate a workforce of approximately 75 – 1,000 employees. It is common for these solutions to be sold through certified Partners that will position the value of their consulting and implementation services. Depending on the vendor, the technology is usually not “leading edge” and the database(s) supported are less expensive and less invasive than Tier I or 2 vendors, such as Oracle or PDS Software. Many of the Tier 3 systems focus on ease of use, base or core functionality and rapid implementation at the expense of a more “strategic” talent management centric solutions. Examples of these vendors include Sage HRMS, InfinityHR, NetSuite Tribe HR and Ascentis.

A recent shift in strategy has forced many Tier 3 vendors to consider strategic partnerships with talent management providers. As a case in point, Sage North America and ADP have recently announced strategic relationships with Cornerstone OnDemand. At this point in time, these new relationships offer their existing clients a path to enhance their existing investments and knowledge by adding specific capabilities such as onboarding, succession planning and LMS (learning management systems) without having to replace and re-deploy an entirely new HRIS. The big question is how well these solutions will really integrate and interact together and the outcome remains to be seen.

TIER 4 VENDORS

Tier 4 solutions are typically offered to companies that may have up to 75 employees. These solutions are extremely simple to learn, require little or no training and can be installed and working within a day. These vendors have a one size fits all approach and offer very little in terms of configuration flexibility and personalization. Many of these solutions can be purchased at local retail stores, such as Staples or Office Max, or directly from the internet with a credit card. Companies close to 75 employees, or those expecting significant growth, would be wise to consider a Tier 3 solution.

GETTING YOUR HRIS/HRMS PROJECT JUSTIFIED AND FUNDED

The term ROI (Return on Investment) may have different meanings to different people in an organization. However, today’s executives, more than ever, are challenged to limit their budgets and squeeze every dollar from their investments. They need to clearly understand the value gained for each dollar spent before your project gets final approval.

Over the years, HRMS Solutions has discovered five compelling reasons for getting projects justified and funded. Listed below are specific business drivers that can be used to justify the investment in your HRIS / HCM project. As a note to HR leadership, documenting and communicating justifications alone will not typically get funding for most projects. You’ll need to become familiar with the concept of TCO (Total Cost of Ownership) and understand both the direct and indirect costs associated with the project over a three, four or even five year period. This, above all else, is the language of the C-Suite.

JUSTIFICATION OF INVESTMENT |

STAFFING |

TRAINING & DEVELOPMENT |

REPORTING |

REWARD |

OPERATIONAL EFFICIENCY |

Minimize recruiting and on-boarding process for a new hire using a single database. | Effectively track and manage employees’ skill development, certification, and performance appraisal. | Track actual hours at job or position level to find opportunities to cut costs (Comp- Ratio). | Minimize costs associated with compensation by evaluating the existing plans. Retain best employees, minimize turnover costs. |

REDUCE COSTLY PAPER AND LABOR INTENSIVE PROCESSES |

Minimize time for recruiting, hiring and on- boarding. | Provide skill development, certification & performance evaluation & action plan in a timely manner.Make the skill development, certification and performance evaluation process efficient. | Track actual hours at activity level to find out if productivity objectives are being met. If not, make real- time adjustments. | Increase productivity of HR staff by automating compensation, HR and payroll administration. |

MAKE BETTER DECISIONS QUICKER |

Better communication between hiring Managers and HR staff.More explicit qualification requirements. Improve quality of hire. |

Help managers make the best decisions on who to use for what job based on skills, performance level and certification.Help managers make the best decisions on how to improve performance of their employees. | Make better decisions regarding the use of workforce by taking into account readily- available employee- centric info such as accrual balances, hours worked, etc. in real-time. | Rewards should be linked to Performance. |

INCREASE EMPLOYEE RETENTION AND SATISFACTION |

Make sure that HR professionals have the right workload and tools to be productive. Ensure that line managers hiring or downsizing requests get processed quickly. | Engage employees in managing their own career advancement through availability of training, career planning process, and career advancement opportunities. | Accurately track employee-centric events to provide employees with accurate and timely benefit info when they need them. | Pay fairly and accurately, according to performance expectations. |

ALIGN HR WITH CORPORATE OBJECTIVES |

Make sure that staffing and skill levels match with the work. | Align individual employee performance goals with corporate objectives. | Examine actual vs. planned hours (which reflect corp. objectives) and make adjustments to stick to budget. | Comply with Government regulations and organization pay rules. |

RECOMMENDED EVALUATION CRITERIA FOR AN HRIS SOLUTIONS

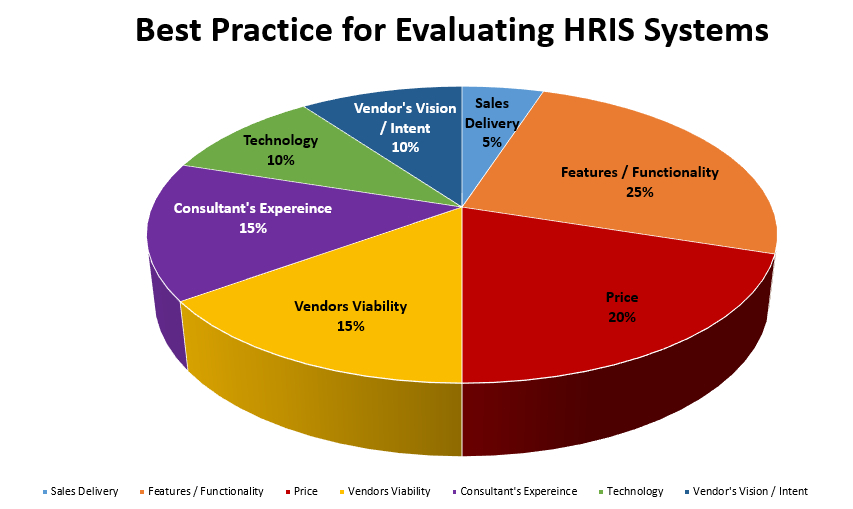

We believe that the lack of a balanced approach to selecting a vendor is one of the most significant pitfalls an organization can make when evaluating and purchasing a solution. Based on our research and extensive experience implementing HRIS solutions, the chart below is a visual representation of how unsuccessful projects are evaluated.

UNSUCCESSFUL PROJECT EVALUATION CRITERIA

Below is a graphical representation for our recommended best practice criteria to properly evaluate a HRIS.

BEST PRACTICE FOR EVALUATING HRIS SYSTEMS

VENDOR VIABILITY CRITERIA

When considering the viability of a long-term business partner, it is critical to evaluate factors such as the vendor’s financial health, marketplace stability and depth of workforce. If the company is public, evaluating their revenue, profits and balance sheet should help support the viability of the vendor. For privately held companies, consider obtaining a letter from the Chief Financial Officer with their financials, to shed insight into their stability.

In addition, understanding the vendor’s market commitment and industry position will also help you determine the potential partner’s ability to execute and deliver. Evaluating the track record of the Executive team and the stability of their workforce, especially the implementation and ongoing support teams, will provide good insight into the vendor’s overall viability.

VENDOR VISION CRITERIA

A company’s vision sets the overall philosophy of an organization. Understanding this will help you determine whether this vendor is credibly positioned to execute its strategic plans – an important consideration. In addition, look at the frequency and scope of their trade show schedule and if they offer a User conference, to get an idea about the vendor’s commitment to their customers and vision.

VENDOR PRICE CRITERIA

You need to consider more than just the first year’s costs when evaluating vendors and their solutions. TCO (Total Cost of Ownership) is a much better approach to determine and capture the initial annual and ongoing costs for your project. In a typical on-premise model, there are usually eight types of costs associated with calculating the TCO.

Listed below is a sample of what you will need to review:

- Application Software License Fees – a one-time expense

- Annual Support and Maintenance – first year, as well as subsequent years

- Consulting, Implementation and Training Fees

- Customization / Modifications Fees

- Travel Related Fees

- Hardware and Software Fees – (SQL Server License, CAL’s, Antivirus)

- Software License Expansion Fees

- Upgrade/NewVersion Consulting and Implementation Fees

- Potential Annual Support Maintenance Fees

In a typical Cloud model the following are typical costs associated with calculating the TCO:

- Activation Fees – a one time expense

- Hosting or Subscription Service Fees – your cost Per Employee Per Month (PEPM)

- Consulting, Implementation and Training Fees

- Travel Related Fees

- Hardware and Software Fees – (SQL Server License, CAL’s, Antivirus)

Buyers also need to be aware of any potential charges associated with consulting services, travel, training, expected increases in annual support and maintenance or hosting fees, as well as fees for additional services such as data history conversion, interfaces, software version upgrades or anticipated technology platform changes.

To help reduce the uncertainty of costs to implement, some vendors will scope the project and offer a “Fixed Fee” versus the typical “Time & Materials” implementation approach. A fixed fee engagement may help limit the risk associated with project “scope creep” and the potential for over charges, however, buyers should be cognizant of any cost for services performed outside the scope of work. An alternative approach is to select a Time & Materials option and ask the vendor to add a “Not to Exceed” dollar amount and use this as a high estimate for the scope of work. This will still provide a chance to hit the low target cost of the project scope, while reducing the uncertainty of “scope creep”. Consider all of your options when given the choice, as many vendors are flexible.

VENDOR TECHNOLOGY CRITERIA

Our experience and research concludes that involving an IT professional early in the evaluation process to help review and eliminate vendors that don’t offer a particular delivery model will dramatically increase the success of the project. This demonstrates your control of the evaluation process, reduces the number of potential vendors that need to be considered to those that are qualified and saves your team time by skipping over irrelevant solutions.

Depending on the scope of the project, a typical requirement for any solution selected is its ability to integrate with the other applications already in production. This is especially important with a Cloud / Cloud-Based solution, considering the data will reside outside of your company’s firewall. Other considerations for evaluating vendor technology include: open standards vs. proprietary, personalization tools/flexibility, third party reporting tools, out-of-the-box integration with existing applications or open API’s (Application Program Interface), hardware and software requirements, web-services capabilities and named versus concurrent application user licenses.

VENDOR SERVICES

Consulting Services is one of the most important and differentiating components when evaluating a solution. It is this group of professionals that will determine the success of the project and its ability to support your initiatives. Critical to the success of the project is a clear understanding of the vendor’s implementation methodology and implementation timeline. Evaluating the maturity and tenure of the vendor’s consulting practice should be considered as part of your vendor assessment. Assessing the availability of those resources and their experience working within your industry on similar projects will help differentiate the vendor. At the appropriate time, you may want to ask the vendor to provide the resume or bio of the consultant(s) that will be assigned to your project should you execute their agreement. Reviewing the lead consultant’s credentials can provide insight and speaking to this individual may also give you some additional comfort about their experience with the solution, ability to transfer knowledge and lead a successful project Look for consultants that, in a professional manner, can challenge the status quo and can clearly explain common project pitfalls. Be on the lookout for signs of demonstrated best practices.

An additional area to consider is the quality and response of technical support and help desk services. For most of the vendors, the customer support help desk is your single source of contact after the consultants have implemented and trained your staff. Understanding operating hours, the escalation process, the average tenure of their staff, any presence of available web tools for customers, customer satisfaction scores and performance measurements can be very helpful in determining the availability, quality and experience of this group.

VENDOR FEATURE / FUNCTIONALITY CRITERIA

Our experience shows that the most effective evaluations include the following:

- A defined project team with a domain expert for each of the functional areas to be considered

- IT leadership

- A defined outline of key business / project requirements

VENDOR SALES DELIVERY CRITERIA

The vendor’s presentation and style in which it is delivered will influence your decision. People tend to buy from people they can relate to and like. Professionals are usually organized, provide details, maintain a good understanding of your business and carefully listen. Recognize that what you are shown in the demonstration, typically the full or a customized system, may not be what you are buying. Be sure to ask what is standard, what is included within each version and what has been customized so that you have the right expectation as the dialogue continues.

DEFINING PROJECT FUNCTIONAL REQUIREMENTS

Below is a general list of functional areas to help you define your project requirements. Many of these areas can also be used in creating an RFI/RFP (Request for Information / Request for Proposal).

GENERAL HR FUNCTIONALITY

- Employee Information (address, emergency contacts, etc.)

- Government Compliance (EEO, OSHA, Vets-100, etc.)

- COBRA/HIPAA Certification

- Alert Notifications

- Employee Correspondence/Mail Merge

- File Attachments

- Employee Notes Tracking (i.e. conversations, disciplinary, etc.)

- Personalization Tools

- Job, Location, Status and Pay History

BUDGET MANAGEMENT

- Position Control

- Salary Planning / Budgeting

- FTE Cost

RECRUITING/CANDIDATE TRACKING / TALENT ACQUISITION

- Job Posting to External Job Boards (i.e. Monster.com)

- Candidate Profile/Self Service

- Candidate Tracking

- Corporate Website/Intranet Site Integration

- Online Applications

- Scheduling Interviews via eMail

- Basic Reporting (cost-per-hire, time-to-fill, etc.)

- Diversity/EEO Reporting

- Contingency/Vendor Management (i.e. temp agencies)

- Employee Referral(s)

- Internal Candidate/Transfers

- Skills/Competency Tracking

- OFCCP Compliance

- Storing Background & Investigative Checks

- Resume Scanning (e-mail or hard copy)

- Searches (internal and external candidates)

SALARY & COMPENSATION MANAGEMENT

- Job/Position

- Salary Grades

- Compa-Ratio

- Range Penetration Analysis

BENEFIT ADMINISTRATION

- Benefit Plan Management

- Automatic Employee Eligibility

- Paperless Online Enrollment

- Vendor Benefit Reconciliation

- EDI (HIPAA compliant 834 files) to Insurance Carriers

- Correspondent Letters (COBRA notifications)

ATTENDANCE MANAGEMENT

- Attendance Management

- FMLA Tracking

- Vacation, Sick, PTO, Holiday Management

TRAINING & DEVELOPMENT

- Skills, Education, Competencies Tracking

- Certification Tracking & Alerting Capabilities

- Training Course Listing, Registration & Employee Completion

- Gap Analysis & Succession Planning

LEARNING MANAGEMENT

- Course Management

- Compliance Management

- SCORM, AICC and IMS Content

PERFORMANCE MANAGEMENT

- Paperless Employee Reviews

- Personalized Review Questions Based on Position

- Journaling

- Cascading Goals and Objectives

- 180 / 360 Degree Reviews

- Straight line and dotted line reviews

SELF-SERVICE AND WORKFLOW

- Employee Self-Service (ESS)

- Manager Self-Service (MSS)

- Candidate Self-Service (CSS)

- Agency Portal

- Web Time Entry and Time-Off Requests

- Electronic Alerts

- Routing & Approvals

- New Hire, Onboarding, Personnel Actions, Terms, Performance Reviews

PAYROLL MANAGEMENT

- Job Costing/ Labor Allocation

- Tax Filing & Electronic Services

- Check Printing & Garnishment Processing

- W-2, W-3 and Year-End Processing

REPORTING / ANALYTICS

- Standard Federal Compliance

- Point-In-Time Reporting

- Query vs. Ad hoc vs. OLAP (Online Analytical Processing)

- Dashboards / KPIs

- Organizational Charting

SOFTWARE DEPLOYMENT COMPARISON MODELS

CLOUD VS. ON-PREMISE DELIVERY

There are typically two general philosophies when it comes to purchasing and implementing new HR/Payroll solutions. Some organizations prefer to purchase an on- premise software license and deploy the solution in their own servers, while others prefer to outsource the application to a vendor who provides a cloud-based delivery model.

Based on our experience, selecting the right delivery model is critical to overall success and should be thoroughly evaluated by both the domain experts (HR/Payroll) and IT professionals within your organization. IT should be involved early in the evaluation process to help evaluate what would be best for the company. Below is a simple matrix that highlights the advantages and disadvantages of each delivery option.

ON-PREMISE ADVANTAGES |

CLOUD ADVANTAGES |

ON-PREMISE DISADVANTAGES |

CLOUD DISADVANTAGES |

| Lowest Total Cost of Ownership Over A Period of (3) Years or More | Offers the Highest Level of Convenience – No Upgrades or Hardware; Access from anywhere | Requires Upfront Investment | Highest Total Cost of Ownership Over A Period of (3) Years or More |

| Offers the Greatest Amount of Flexibility and Ease of Integration; Personalization; Customizations possible | No Software, Hardware or Upgrades | May Require An Investment in Hardware & Software (OS and Database Licensing) | May Require A Pre- Payment Upfront Potential Integration Challenges Less flexible for customizations (if any allowed) |

| Investment Can Be Capitalized and Depreciated | Speed to Deployment | Potential Longer Implementation Cycle | Limited Ability to Capitalize the Investment |

| Data Secured within Client’s Environment (i.e. behind Client Firewall) | Cloud Provider Responsible for Hardware and Software Maintenance, Security and SSEA16 Certification | On-going IT Support Required (Periodic Application and Server Maintenance) | Potential for Disruption of Service if Internet Outages Occur, Vendor M&A Activity or Goes Out of Business |

ON-PREMISE ADVANTAGES

On-Premise software has been the most popular delivery model selected by mid-market businesses. This option is best aligned for those organizations that have an existing IT staff and infrastructure. Typically, an On-Premise delivery model provides the lowest TCO over a period of three years or more.

An On-Premise solution resides behind the client’s existing security and firewall infrastructure. This avoids the common challenges found when moving data from a hosting vendor’s network through the Internet and past your network security and firewalls into your HRIS database server. Finally, the On-Premise delivery model allows your Finance department to depreciate the asset, called Capitalization, which includes the Professional and Training Services required for implementation.

ON-PREMISE DISADVANTAGES

Besides the upfront investment to purchase an On-Premise software license, there could be additional hardware and software costs that may be incurred. For example, a Microsoft centric application may require the purchase of SQL Server and CAL’s (Client Access Licenses), as well as the hardware required to support the HRIS application. Other additional costs could include Anti-Virus and Back-up software, and potentially any third party reporting tools that may be needed. Software licensing that must accompany or reside on the physical hardware is usually more expensive than hardware itself. SQL Server licensing, for example, comes in two editions (Standard or Enterprise) and its price is subject to change at Microsoft’s discretion. The cost for SQL Server Licensing is based on the number of CPU’s in each server, which is currently about $5,000 per CPU.

Other On-Premise costs to consider include the resources required to initially get the new application loaded onto an existing server(s) or installed on a new server which must be built. This will require IT involvement, as well as an ongoing effort to maintain the HRIS software, the operating system and database. Overall, there are both upfront costs and internal resources required to deploy HR/Payroll software in a self-hosted On- Premise model, as well as performing on-going support to the solution’s software and hardware.

CLOUD ADVANTAGES

The primary advantages to the Cloud model, which is only delivered via the web, include the outsourcing of IT resources to support and maintain the Cloud application, the speed of initial application deployment, a lower first year investment cost and the elimination of costly and time consuming future software application upgrades. In the Cloud model, an organization will also be able to reduce or eliminate other indirect costs (e.g. salaries, health care, liability, physical hardware, utilities, and building space) which are generally associated with insourcing IT systems. Another key advantage is that an organization’s IT department no longer needs to provide performance tuning, daily back-ups, installation of software updates and service packs, or a resource for help desk support and trouble shooting. These traditional IT related duties rest upon the Cloud vendor.

A first-rate Cloud provider leverages a multi-tenant infrastructure environment and product architecture which enables service packs and enhanced features to be released to all clients with little or zero involvement from the client’s IT personnel. This typically allows the end-users to leverage new features immediately, versus waiting for internal IT resources to download, apply and test a vendor’s new software release.

Finally, clients are able to use a Cloud vendor’s application on an as-needed or on- demand basis. This eliminates potentially high initial Year 1 costs associated with acquiring and implementing software On-Premise. Clients in a Cloud model can typically be using and reaping the benefits of the software immediately for their recurring lease of the software.

CLOUD DISADVANTAGES

Even though the overall hype about moving to a Cloud delivery model offers a lower cost of investment, characteristically it has the highest TCO for a period of three or more years. Most Cloud vendors charge clients a “subscription” or “hosting” fee on a PEPM (Per Employee per Month) basis. This provides the Cloud vendor with a predictable recurring revenue stream.

From an accounting standpoint, a Cloud solution is commonly treated as a monthly recurring expense. This is unlike the self-hosted On-Premise license model, which can be depreciated as an asset.

With regards to software limitations, some Cloud vendors may not have a sophisticated or modern architecture or related tools for an efficient, scalable and configurable multi- tenant environment. Therefore, some of their application functionality may be limited in the areas such as: reporting, system configuration and modifications, integration methods and utilities, and overall enterprise-wide access and aggregation. For example, consider system integration. Depending on the vendor’s architecture, a Cloud provider may have real difficulties when it comes to enterprise-wide or third party software integration. Firewalls, anti-virus programs, spam filtering, and other related IT security measures may present integration challenges to a Cloud HR/Payroll application due to the multiple security layers in place to safeguard a client’s network and information.

THE HYBRID MODEL

Finally, a new delivery model is emerging in the market called a “Hybrid” model. This new model is gaining momentum and offers clients the ability to purchase a software license and the vendor provides remote hosting services that are less than the Cloud PEPM fees. The Hybrid model generally has a lower TCO than Cloud and is popular from the financial aspect of capitalizing the software and the convenience for the IT professionals by outsourcing these services. We will continue to monitor the pulse of the market for this evolving delivery model.

CONCLUSION

Overall, the decision to deploy software in an On-Premise, Cloud or Hybrid model will depend on several factors, including initial and subsequent year’s budgets, short and long term organizational goals, and IT philosophy regarding resources and systems (e.g. hardware, software, and internal IT personnel).

MISTAKES TO AVOID WHEN IMPLEMENTING HRIS/HRMS SOFTWARE

HRMS Solutions, Inc. understands that in addition to a new system implementation, clients must still maintain their busy day-to-day HR workloads. Best practice shows the most successful and cost effective implementations occur when avoiding the following common project land mines:

- Selecting software and vendors without fully understanding and considering all of the project objectives and technology requirements.

- Viewing technology as the “silver bullet” to your challenges, rather than as part of the overall business solution that aligns with an organization’s strategy and incorporates critical elements such as people and business processes.

- Making investments with incomplete financial information and project risk assessment.

- Contracts that fail to ensure accountability; Limited details about the vendor’s implementation methodology and no project timeline.

- Not taking the time to test and validate the configuration of the software application.

- Placing too much emphasis on the application’s ability to mirror existing business and work-flow processes versus understanding the application’s ability to change and conform to any business and work-flow process.

- Delivering a new solution into production without first having a pilot test group.

- Underestimating the amount of impact and change the application has on the organization.

- Not effectively supporting data management or the application after post implementation.

- Not having a contingency plan for all phases of the project.

- In general, not heeding the advice of the vendor’s suggested implementation timeline and trying to condense the project into unrealistic or unachievable goals.

- The vendor’s Project Manager does not have ready access to the client’s internal Project Manager.

CONCLUSION & RECOMMENDATIONS

Determining the right solution for your organization based on your requirements, budget and culture is the responsibility of the project team. Spend your time adequately planning for the project and adopt a structured, methodical approach. This HRIS Planning Guide will save you countless hours, wasted dollars and considerable stress. Allow the project team to thoroughly evaluate qualified vendors, as it will have a direct impact on the success of the project. Short cutting the evaluation process is risky and can easily lead to choosing the wrong vendor and solution.

It is important to understand that the sales person you are dealing with from each vendor is trained to “control” the sales process and keep you away from the inevitable weaknesses in each solution’s product or service. Aligning yourself with the processes in this guide gives you the knowledge and confidence to deal with vendors in an objective way that highlights your business issues and goals.

Final thoughts with lessons we learned the hard way:

- The “leading” solution may not be the right one for you.

- Assigning an Executive sponsor to the project is critical.

- Implementation services represent the greatest risk of any solution and are typically the most expensive component.

- Interview the consultants that will be delivering the solution.

- Avoid “scope creep” by creating a detailed internal assessment and project charter.

- Understand how to escalate matters with the vendor prior to an issue becoming critical.

- Allow enough time for the project team to do a thorough evaluation of the vendors.

- Avoid assembling an inadequate project team.

- Insist on a formal change order process.

- Hire an experienced consultant if you do not have the time or experience to adequately plan.

- Software cost is only a piece of the Total Cost of Ownership.

- Avoid customizations unless they are absolutely necessary.

- Purchase solutions built on open technology standards.

- Be willing to evaluate and adjust existing business processes.

- Evaluate the solution more than once.

- Do at least three reference checks with customers on the current version of proposed solution and make sure they have similar operating environments, such as the same payroll service bureau or software.

- If something is important to you, make sure it is in the agreement.

- Have a portion of the consulting services due after “go-live”.

- Choose the appropriate time to sign your agreement.

- Product training for internal Project Managers before implementation begins can avoid later costly change orders.

- Understand the responsibility of expected travel costs and manage travel wisely.

- Be responsive — Keep acceptable response times to requests made from the vendor’s Project Manager.

- Allow time to collect and carefully cleanse data before migration. Then cleanse it again.

- Keep the internal focus on the system implementation and make certain Executives stay current and are informed.